Example Households

(Note: This page is part of the 2025 Housing Snapshot report)

Housing needs and choices range widely among Madison households based on income, number of people in the household, age of individuals, and much more. Many households face decision-making challenges when balancing housing with other needs. In order to help readers understand financial realities and challenges that different households in Madison might face, we’ve compiled 12 fictitious, yet realistic, example households that range from extremely low income (at or below 30% AMI) to above average income (150% AMI).

Each example describes the estimated monthly costs of living, including a real 2025 example home they might rent or purchase. Some Madisonians have far more housing choice than others, and it's critical that we understand the people behind our housing data.

When reading through the Housing Snapshot or reviewing data visuals, we encourage readers to pause and reflect on these examples and other people they might interface with who are in similar circumstances.

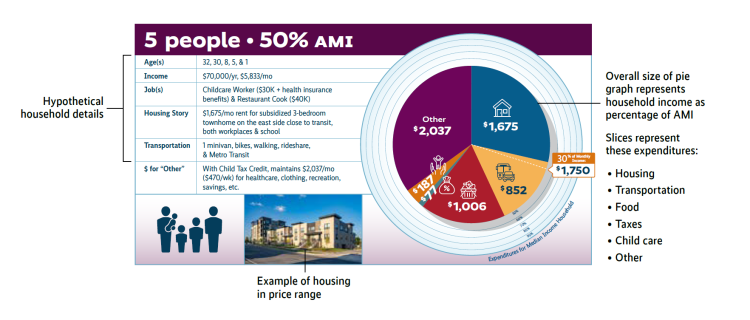

One-person household earning 30% AMI

Age(s): 81

Income: $24,000 per year/$2,000 per month through Social Security

How much could they afford to spend on housing? $600 per month

Job(s): None currently, worked various jobs from ages 18-72.

Housing Story: This person is housing cost-burdened, spending $925 per month for a subsidized one-bedroom apartment near West Towne Mall. They sold their house in 2015 following their spouse's death. Since then, they have used savings for a sibling's medical expenses and previously rented a market-rate apartment.

Transportation: Does not own a car, using Metro Transit and rideshare services instead.

Money for Other Expenses: $381 per month ($88 per week) left for medicines, clothing, etc.

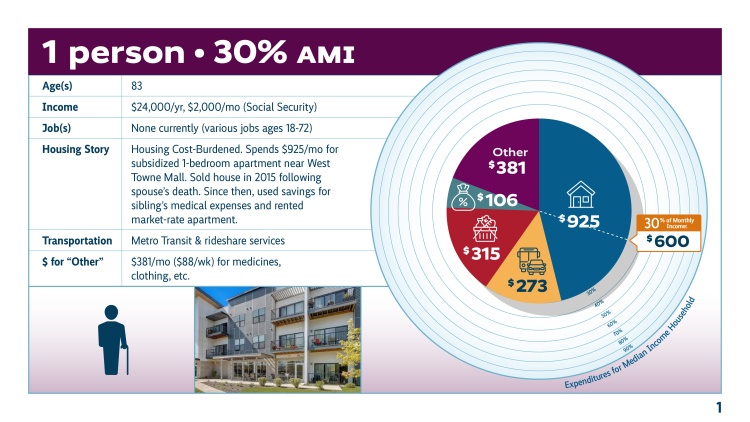

Four-person household earning 30% AMI

Age(s): 25, 6, 2, and 6 months

Income: $35,000 per year/$2,917 per month

How much could they afford to spend on housing? $875 per month

Job(s): Hotel desk clerk, which includes partial health insurance benefits. Works days while taking online hotel management courses.

Housing Story: This household spends $1,000 per month for rent and utilities on a deeply subsidized east side three-bedroom apartment after looking for a similar rate closer to their workplace.

Transportation: One older car, drives 25 minutes to work on the far west side.

Money for Other Expenses: With Earned Income Tax Credit, $588 per month ($135 per week) left for healthcare, clothing, savings, etc.

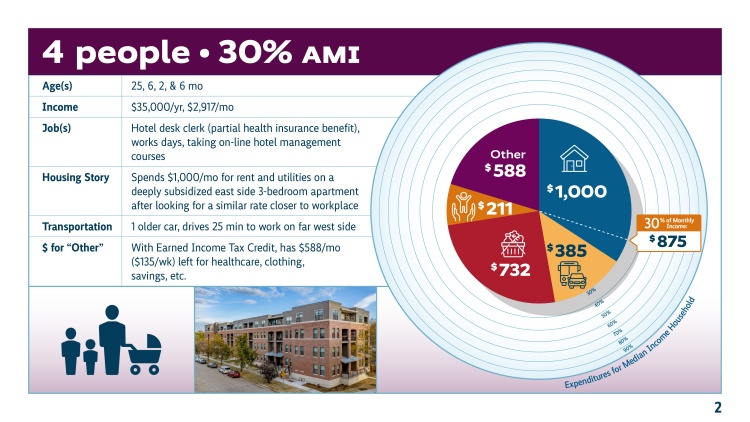

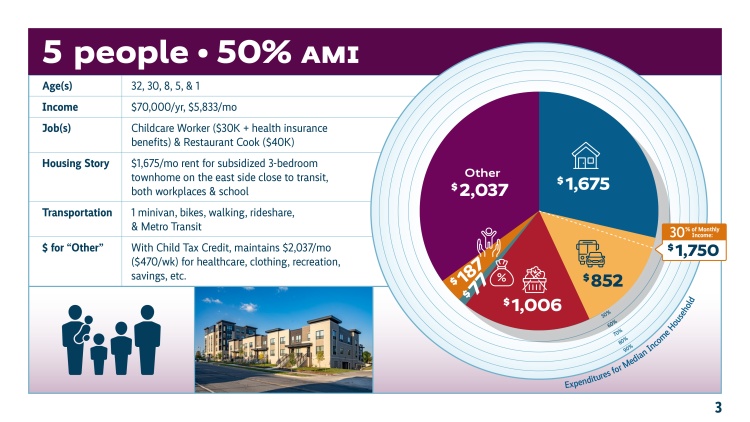

Five-person household earning 50% AMI

Age(s): 32, 30, 8, 5, and 1

Income: $70,000 per year/$5,833 per month

How much could they afford to spend on housing? $1,750 per month

Job(s): Childcare worker ($30,000 per year and health insurance benefits) and restaurant cook ($40,000 per year).

Housing Story: This household spends $1,675 per month for a subsidized three-bedroom townhome on the east side that is close to transit, both workplaces, and school.

Transportation: One minivan, otherwise rely on Metro Transit, rideshare services, walking, and biking.

Money for Other Expenses: With Child Tax Credit, $2,037 per month ($470 per week) left for healthcare, clothing, recreation, savings, etc.

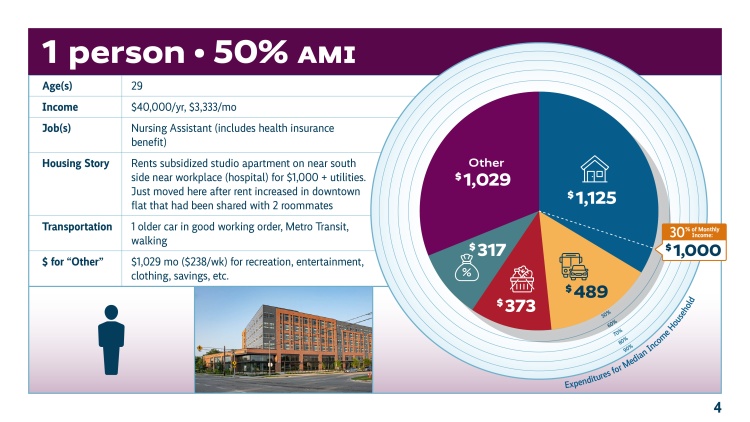

One-person household earning 50% AMI

Age(s): 29

Income: $40,000 per year/$3,333 per month

How much could they afford to spend on housing? $1,000 per month

Job(s): Nursing assistant, which includes health insurance benefits.

Housing Story: This person rents a subsidized studio apartment on the near south side near their workplace for $1,000 per month plus utilities. They moved to this apartment after rent increased in a downtown flat they had been sharing with two roommates.

Transportation: One older car in good working order, Metro Transit, and walking.

Money for Other Expenses: $1,029 per month ($238 per week) left for recreation, entertainment, clothing, savings, etc.

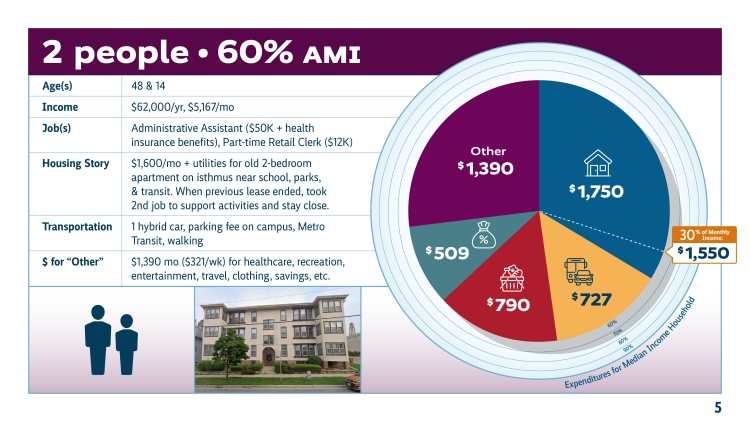

Two-person household earning 60% AMI

Age(s): 48 and 14

Income: $62,000 per year/$5,167 per month

How much could they afford to spend on housing? $1,550 per month

Job(s): Administrative assistant ($50,000 per year plus health insurance benefits), part-time retail clerk ($12,000 per year).

Housing Story: This household spends $1,600 per month plus utilities for an old, two-bedroom apartment on the isthmus near school, parks, and Metro Transit. When their previous lease ended, the adult took a second job to support activities and stay close.

Transportation: One hybrid car, pays parking fees on campus. Also walks and uses Metro Transit.

Money for Other Expenses: $1,390 per month ($321 per week) left for healthcare, recreation, entertainment, travel, clothing, savings, etc.

Five-person household earning 60% AMI

Age(s): 48, 40, 4, 2, and 78

Income: $84,000 per year/$7,000 per month

How much could they afford to spend on housing? $2,100 per month

Job(s): 3rd grade teacher ($50,000 per year plus health insurance benefits), library technician ($34,000 per year).

Housing Story: This household rents a modest, three-bedrom northside home near school for $1,800 per month plus utilities. They are looking to move into a subsidized three-bedroom home, as rent will increase to $2,000 per month next year.

Transportation: One accessible minivan, one older car. Also uses Metro Transit and walks.

Money for Other Expenses: $596 per month ($138 per week) left for healthcare, clothing, savings, etc.

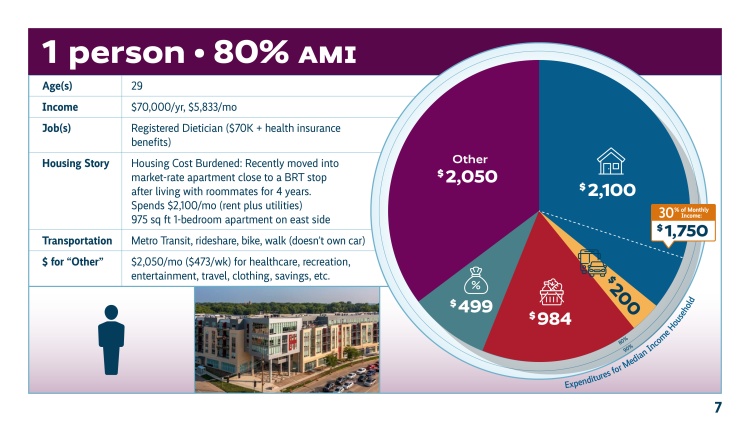

One-person household earning 80% AMI

Age(s): 29

Income: $70,000 per year/$5,833 per month

How much could they afford to spend on housing? $1,750 per month

Job(s): Registered dietitian, includes health insurance benefits.

Housing Story: This person is housing cost-burdened, spending $2,100 per month in rent and utilities after recently moving into a 975-square foot market-rate apartment close to a BRT stop on the east side. They previously lived with roommates for four years.

Transportation: Does not own a car, using Metro Transit and rideshare services instead. Also bikes and walks.

Money for Other Expenses: $2,050 per month ($473 per week) left for healthcare, recreation, entertainment, travel, clothing, savings, etc.

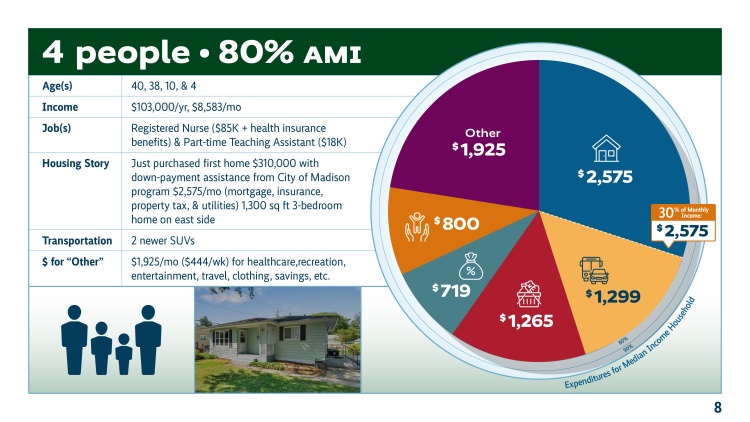

Four-person household earning 80% AMI

Age(s): 40, 38, 10 and 4

Income: $103,000 per year/$8,583 per month

How much could they afford to spend on housing? $2,575 per month

Job(s): Registered nurse ($85,000 per year plus health insurance benefits), part-time teaching assistant ($18,000 per year).

Housing Story: This household just bought their first home for $310,000 using down-payment assistance from the City of Madison. They spend $2,575 per month on the mortgage, insurance, property tax, and utilities on the 1,300-square foot, three-bedroom home on the east side.

Transportation: 2 newer SUVs

Money for Other Expenses: $1,925 per month ($444 per week) left for healthcare, recreation, entertainment, travel, clothing, savings, etc.

Three-person household earning 100% AMI

Age(s): 31, 28, and 3 months

Income: $120,000 per year/$10,000 per month

How much could they afford to spend on housing? $3,000 per month

Job(s): Firefighter ($60,000 per year plus health insurance benefits), school social worker ($60,000 per year).

Housing Story: This household purchased a condo for $330,000 on the far west side after renting since college and saving for a downpayment. The 1,600-square foot, two-bedroom flat is in a two-unit building. They are paying $2,500 per month for the mortgage, insurance, and property tax, as well as a $350 per month condo fee plus utilities.

Transportation: 1 electric car and 1 newer minivan

Money for Other Expenses: $1,320 per month ($305 per week) for healthcare, recreation, entertainment, travel, clothing, savings, etc.

One-person household earning 100% AMI

Age(s): 27

Income: $85,000 per year/$7,083 per month

How much could they afford to spend on housing? $2,125 per month

Job(s): Radiation therapist, includes health insurance benefits.

Housing Story: This person just moved back to Madison after graduating from college. They rent a studio apartment in a large apartment building on the far east side near their workplace for $1,300 per month plus utilities. They could afford to pay more, but are prioritizing savings, travel and entertainment.

Transportation: 1 new SUV, also uses Metro Transit and bikes and walks.

Money for Other Expenses: $2,941 per month ($679 per week) for healthcare, savings, travel, entertainment, clothing, etc.

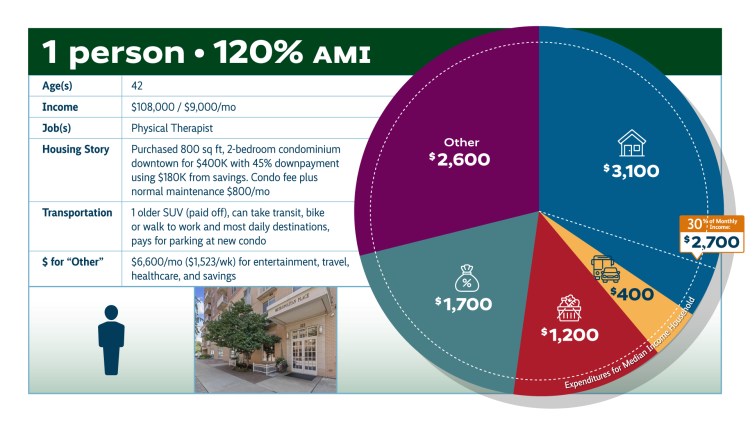

One-person household earning 120% AMI

Age(s): 42

Income: $108,000 per year/$9,000 per month

How much could they afford to spend on housing? $2,700 per month

Job(s): Physical Therapist

Housing Story: This person bought an 800-square foot, 2-bedroom condominium downtown for $400,000 with a 45% downpayment using $180,000 from savings. Condo fees and normal maintenance add an additional $800 per month.

Transportation: 1 older SUV that is paid off; can also take transit, bike or walk to work and most daily destinations; also pays for parking at their condo building.

Money for Other Expenses: $6,600 per month ($1,523 per week) for entertainment, travel, healthcare, and savings.

Two-person household earning 150% AMI

Age(s): 32 and 30

Income: $156,000 per year/$13,000 per month

How much could they afford to spend on housing? $3,900 per month

Job(s): Veterinarian ($100,000 per year plus health insurance benefits) and Non-profit program director ($56,000 per year)

Housing Story: This couple rents a 1,900-square-foot townhome on the far west side for $2,900 per month plus utilities. They are saving for a downpayment to buy their first home.

Transportation: 2 hybrid SUVs with heavy usage to get to and from work and activities.

Money for Other Expenses: $4,550 per month ($1,050 per week) for healthcare, recreation, entertainment, travel, clothing, savings, etc.

Sources (for all): WHEDA Area Median Income (AMI), Household Size & Income Levels as % AMI for Madison, WI (2025); Bureau of Labor Statistics Jobs & Income Data for Madison, WI (2024); BLS Average Household Expenditures (2023); USDA food costs by # in Household (2025); State of WI Income Tax Rates (2024); Federal Income Tax Rates, Child Tax Credit, & Earned Income Tax Credit (2024); MLS & For Rent Listings in Madison, WI (Summer 2025)

Housing Initiatives

-

2025 Housing Snapshot

- Common Terms and Categories

- City of Madison Growth Trends

- Who Lives in Madison?

- New Housing Construction

- Rental Housing Market

- Homeownership Market

- Housing Cost Burden

- Cost of Construction and Inflation

- Impact of City Funding on Housing Supply

- Homelessness

- Tenure Transition in 1-unit Structures

- Data Sources

- Housing Tracker