2025 Budget Outlook

postedDear friends and neighbors,

As some of you are aware, the Common Council received a briefing on the outlook of the 2025 budget. To put it bluntly, it’s a grim outlook. We find ourselves confronted with a staggering $27 million structural deficit - a sum we simply do not have. We are thus faced with tough decisions, including a referendum and/or staff reductions.

This structural deficit is the most important issue our city is facing today and in the foreseeable future. Every part of our city — from housing and transportation to public safety and homelessness — is interwoven into our budget decisions. The responsibility falls squarely on us, the elected officials of Madison, to navigate this fiscal dragon. Abstaining is not an option.

Addressing this crisis demands a collective effort. Yes, that means each and every one of us, including you. Madison residents will soon face a difficult decision on the ballot regarding a referendum to accept higher property taxes or contend with the repercussions.

As someone who believes that good governance is rooted in truth and transparency, I am coming to you to share relay the 2025 budget briefing and provide an opportunity for you to digest and give feedback. My hope is that this blog serves to educate on the tough decisions ahead and inspire active engagement from you all.

BEFORE YOU READ

Buckle up friends, because this is a longer blog post. The information in this blog is mainly taken from the Finance Department's 2025 Budget Outlook page. This includes recordings from the Finance Department and Council's latest public meeting.

Your feedback on this blog and how we should proceed is greatly appreciated. My top priority is representing the best interest of District 2 and the City of Madison. Please let me know how I can best support your needs in this budget crisis.

My Priorities Going into the 3/5 Meeting

At the March 5th meeting, Council will enter a meeting of the whole in which we will discuss and hopefully come to a mutual agreement on the direction to give staff for the upcoming budget cycle. My priorities are...

- Minimize position and service reductions.

- Mitigate housing cost increases.

- Maximize all available tools.

To do this, we will need to go to referendum to increase property taxes. We simply cannot continue basic city services without referendum. If voters do not support referendum in the November election, we are facing laying off over 270 municipal employees. That means we will have to gut entire departments - planning, transportation, etc. - in order to balance our budget. This catastrophic outcome is not an option.

The most important question then becomes how much do want the referendum to be. We could do a referendum asking for the current $27 million budget deficit. We could go higher into the $30 millions to meet potential future deficits. We could also go lower than $27 million and make up the difference in fee increases and/or layoffs. Council and the Mayor will need to agree on a path forward before the budget kickoff in April.

SUMMARY

Budget 101: Navigating Madison's Financial Landscape

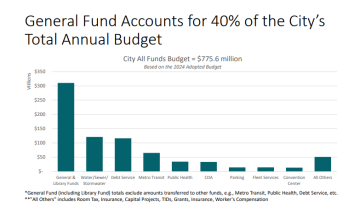

Madison's budget revolves around two key components: the capital budget and the operating budget. The capital budget, spanning five years, funds major projects like infrastructure upgrades and facility construction, totaling $376.5 million for 2024, mainly financed through borrowing and utility revenues impacting property taxes. On the other hand, the operating budget, covering a year, sustains day-to-day city operations, amounting to $382.3 million in 2024, primarily supported by property taxes funneled through the General Fund.

The Important Role of Property Taxes

Property taxes serve as Madison's primary revenue source, forming 70% of the budget. While the city explores alternative revenue streams like service charges and grants, property taxes remain pivotal. Unfortunately, state restrictions limit diversification into sales or income taxes, crucial for a balanced revenue mix.

Roots of the Budget Crisis

The budget deficit traces back to Wisconsin's Act 10 in 2011, hampering local governments' ability to raise property taxes and thereby straining operational budgets. The COVID-19 pandemic exacerbated financial woes, shrinking revenues and inflating costs, though federal aid partially cushioned the blow. Further, public policy decisions exacerbated the budget crisis.

Addressing the Deficit: Tough Choices Ahead

Balancing the budget necessitates increasing revenues or cutting expenses. Options include raising property taxes through a referendum, albeit with implications for taxpayers, or enhancing non-property tax revenues, albeit with limitations. Reducing expenses entails across-the-board cuts or salary reductions, albeit risking service disruptions.

Finding a Way Forward

Navigating the budget crisis requires collective action from city officials and citizens alike. Transparency, shared responsibility, and prudent decision-making are paramount. While there are no easy solutions, collaboration and informed decision-making are key to steering Madison towards fiscal stability.

BUDGET 101: MADISON’S FISCAL LANDSCAPE

Madison’s budget is split into two parts: the capital budget and operating budget. The operating budget is where the city’s current deficit is derived.

- Capital budget: provides funding for the city’s major construction projects, such as building new facilities, improving the transit system, maintaining the roads and parks, and purchasing major equipment.

- Operating budget: provides money for running the city departments and services, such as public health, police, libraries, and more. The operating budget pays for the day-to-day spending on employees and materials and supplies.

- Levy limit: restrictions on how much a city can increase its property tax levy from year to year. The basic rule is that a city can only increase its levy by the percentage change in its equalized value due to new construction, but not less than zero percent.

Property Taxes are the City’s Main Source of Funding

The general fund is the focus of the budget, because property taxes are the main revenue source. According to the Wisconsin Policy Forum of 2019, Wisconsin municipalities depend on property taxes more than any other Midwestern state. Although the state recently passed a new shared revenue bill, this bill primarily supported rural communities and did little in favor of larger municipalities. As a result, property taxes are our main source of revenue.

Unfortunately, Wisconsin's state regulations

prohibit alternative income sources like sales and income taxes, limiting Madison's revenue options. While a sales tax could capture revenue from visitors, and an income tax could distribute costs equitably, both are currently unattainable due to legislative constraints. Despite recent allowances in Milwaukee, Madison faces different priorities and limitations, making similar agreements unfeasible. While future changes may be possible, the current landscape necessitates managing expectations and exploring alternative revenue sources to address the budget deficit.

ROOTS OF THE BUDGET CRISIS

Gov. Scott Walker and the State Legislature

The current situation traces back to the 2011 Wisconsin Act 10, which severely restricted collective bargaining rights for most public employees and imposed strict limits on local governments' ability to raise property taxes. Previously, Madison could simply adjust levy limits to match inflation and service demands. However, post-2011, this flexibility was stripped, widening the funding deficit. Instead of gradual property tax increases, we now need to seek voter approval to bridge a 12-year shortfall.

The Lasting Impact of COVID-19 Pandemic

The pandemic has had a lasting impact on revenues by reducing the income of various sources outside of property taxes. According to the U.S. Department of

Treasury, the city lost $31 million in 2020 and $16 million in 2021 due to the pandemic. The city also faced increased costs for public health, emergency response, and social services.

The city of course was able to offset some of these revenue losses from the American Rescue Plan Act (ARPA) to offset some revenue losses and expenses. To Mayor Satya’s credit, the mayor’s office distributed ARPA dollars extremely well, allowing our city to perform better than neighboring cities on ARPA dollars.

The Mayor’s Office and Common Council

I want to make myself abundantly clear that this section is not written to admonish any one specific mayoral administration(s) or council member(s). Frankly, I could care less about the politics of calling in local elected spending habits. You deserve truth and transparency. As such, this section is written to articulate shared responsibility of local elected officials in adding to our current budget deficit.

Part of the increase were necessary expenses to meet the growing city’s needs due to natural population increases and the addition of the Town of Madison. These increases include, but are not limited to…

- Transportation: The transportation programs account for 22.9% of the total operating budget in 2024, up from 19.6% in 2011. The city is also planning to launch a Bus Rapid Transit system by 2025, which will require additional operating funds.

- Affordable Housing: The city allocated $7.5 million for the Affordable Housing Fund to create or preserve low-cost units. It also funded the Homeless Services Consortium ($2.5 million) and the Tenant Resource Center ($1.5 million) to provide rental assistance, shelter, mediation, and other services to prevent homelessness and evictions.

- Public Safety and Health: For example, the Common Council routinely accepted Cop Grant funds to increase police officers without care for the long-term budget increases of hiring new employees we did not have funds to pay for.

There have been expenses from 2011 that in retrospect that could have been set aside or taken up in time, until our operating budget was under control. For example…

- The 2012 budget included one of the largest salary increases to police and fire in recent years. This increase had ripple effects over future budget years, especially since all other public employees do not have collective bargaining rights. This motivated large wage parity gaps that the Common Council chose to close in recent years, causing even more pressure on our operating budget.

- There have been a wide range of mayor and alder pet projects. Some examples include Midtown Police Department, Lisa Link Peace Park, Bus Rapid Transit, and the Madison Public Market. Many of these are lovely additions to our city but bore consequences that could have been postponed or drawn out over the years.

It is easy for us local elected officials to point fingers at the state or unforeseen circumstances, but in all, this is our job and as such our responsibility. We must take responsibility for adding to the problem to find a solution.

Past Budget Balancing Measures

Since allowable levy increases do not keep pace with cost growth, the city has implemented numerous cost savings measures over the years. This has steadied major operating deficits over the years.

It is important to note that aside from these cost savings measures, each year each agency is down 10% in staffing, across the board. Population has kept increasing. We can’t continue to keep up with staffing levels.

ADDRESSING THE DEFICIT: TOUGH CHOICES AHEAD

This is the hard part. There is no one right answer and somehow the 20 alders and the mayor will ultimately need to decide on a path forward within the month At the March 5th Common Council meeting, alder will enter a committee of the whole, where we will discuss amongst each other and give direction to staff and the mayor’s office on how Council would like to approach this year’s budget.

Basic Rules:

- By law, the operating budget must be balanced. Revenues = Expenses. Very simply, to balance the 2025 operating budget, we must increase revenues and/or reduce expenses. We must plan to tackle the 2025 $27 million deficit and a $60 million future deficit, depending on Council’s action or lack thereof.

- The city cannot cut debt service on already issued debt. For example, we cannot simply choose to halt payments on construction of the BRT, the Public Market, or Reindahl Imagination Center. Otherwise, we would default on our debt.

- Reducing borrowing in the capital budget would help lower property tax increases, but does not address the operating budget structural deficit. Since capital budget expenses are paid through property taxes, lowering additional capital expenses would decrease property tax increases. However, the operating budget is separate from the capital budget. So, tackling today’s problem must focus on the operating budget.

Expenses

The following demonstrates cost saving measures as it relates to reducing expenses by $27 million. It is important to note that a recently enacted state law named “Public Safety Maintenance of Effort” adds pressure. Public safety and health accounts for the largest share of our budget—$172 million or 42.5%. State law would penalize the city by a 15% reduction in shared revenue ($1.2 million) if we do not meet their parameters below, thus limiting options for reducing expenses in our largest agencies.

Reduce all/most agencies by the same amount.

- Including police and fire: 8% reduction (each 1% = $3.4 million)

- Excluding police and fire: 15% reduction (each 1% = $1.8 million)

This is equivalent to the entire Streets Division ($27 million), most Planning, Community and Economic Development ($28 million), or most administrative agency budgets ($31 million).

Reduce municipal employee salaries

$27 million = 9% reduction in all municipal employee salaries.

- Including police and fire: each 1% reduction in pay = $3 million

- Excluding police and fire: each 1% reduction in pay = $1 million

Roll back new programs

New programs, such as CARES, Office of the Independent Monitor, Parks Alive, shelter operations have added $2.2 million to the operating budget. These expenses will increase with the completion of capital projects, such as BRT, the Public Market, and Reindahl Park Imagination Center.

My Take…

Position and service reductions of this magnitude are simply unacceptable in my opinion. A massive loss in positions would result in major reductions in services to a city that is already operating at only 90% of the city’s current needs. Consider if the building blocks of city services—snow and trash removal, building inspection, librarians, homeless services—ground to a halt. Scary.

I would, however, like to at the very least explore a 1% reduction across all city agencies. I am also curious about ways to bring the police and fire budget back under control. It is important for everyone to note that if we do not accept revenue measures like a referendum or new fees, we will be forced to cut services and positions.

Revenues

Increase property tax (“levy”) through voter referendum.

A referendum to increase the city’s levy limit in Madison is a ballot measure that asks voters to allow the city to raise its property taxes above the state-imposed limit. A referendum must specify if it’s one year or over a number of years. The referendum must also be approved by the Common Council before it can be placed on the ballot.

A referendum to increase the city’s levy limit in Madison would provide more revenue for the city to maintain or enhance its services, but it would also increase the property tax burden. The City of Madison Finance Department suggests that referendum would increase property taxes by an average of almost $400 per year or $33 per month to property owners. The city’s PCED department also anticipates that property taxes would be pushed onto renters, instead of landlords accepting a lower rate of return. In essence, it will increase housing costs. Scary.

Increase Non-Property Tax Revenues

The city has limited non-property tax related revenues. To recover $27 million, the city would need to increase all local revenues by 50%.

- Charges for services (ie. ambulance fees)

- Licenses and permits (building permits)

- Fines and Forfeitures (ie. parking violations)

- Other (ie. room tax, investment earnings)

There are additional special charges that the city could levy. Special charges, according to state law, must be used for a “broad-based” public benefit. Currently, the city has two special charges, including urban forestry and resource recovery (recycling). Other possible options are:

- Transportation: up to $30 million

- Library: up to $20 million

- Parks: (up to $15 million

Each $1 per month per resident raises $1 million in revenue. $27 million equals $27 per month or $324 per year per resident.

My Take…

A referendum seems like the most reasonable but admittedly difficult choice to make to avoid severe budget cuts. I would like to offset the referendum with a multifaceted approach, including increasing user fees and additional cost saving measures.

Sources

- https://media.cityofmadison.com/Mediasite/Showcase/madison-city-channel/Presentation/c1efa19dc30a40519771e472a43c62f21d

- https://madison.legistar.com/DepartmentDetail.aspx?ID=17248&GUID=09B17CD6-CEFD-4DFC-9A6E-F47D545D907D

- https://wispolicyforum.org/research/dollars-and-sense-is-it-time-for-a-new-municipal-financing-framework-in-wisconsin/

- https://www.cityofmadison.com/finance/budget

WHAT DO YOU THINK?

Please email me at district2@cityofmadison.com with your thoughts on how we should proceed!